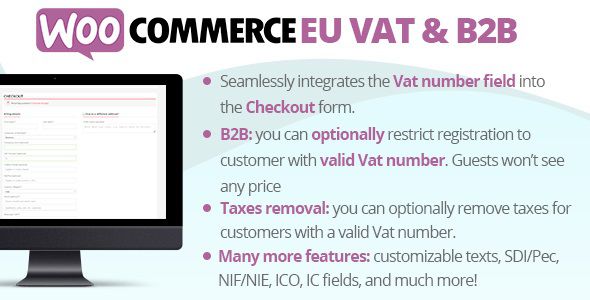

WooCommerce Eu Vat & B2B

$3.90

Original Product

Lifetime Updates

Unlimited Website Usage

Safe & legal under GPL

WooCommerce EU VAT & B2B is a powerful plugin designed to simplify tax compliance and business-to-business sales for WooCommerce stores operating in the EU. It automatically calculates VAT based on customer location, validates VAT IDs, and supports B2B pricing rules.

Key Features:

-

Automatic EU VAT Calculation

Calculate VAT automatically based on the customer’s EU location. -

VAT ID Validation

Validate customer VAT numbers to ensure B2B compliance. -

B2B Pricing & Discounts

Offer special prices or discounts for business customers. -

Tax-Free Purchases for Verified Companies

Enable VAT-exempt purchases for approved B2B clients. -

Flexible VAT Rules Configuration

Customize tax rates, rules, and exemptions per country or customer type. -

WooCommerce Compatible

Fully integrated with WooCommerce checkout and product pages. -

Improved Compliance & Reporting

Generate accurate VAT reports and reduce tax errors.